However you view the last decade; either as a period of prosperity and optimism (The Teens) or turbulent uncertainty (The Ten-sions), there were certainly good and bad factors for everybody. Change in the property sector isn’t looking set to level off and dwindle with the dawn of the 20’s either, so the new decade will continue to see an ever changing environment for operating.

Here are some of the key areas that will affect renting over the next decade, the ones we can at least predict for now, as there are sure to be changes that we cannot yet foresee.

More people will be living longer

One thing is for sure, people are living longer. Life expectancy has been on the steady rise since the middle of the 19th Century with 2019 seeing the averages reach 83.2 years for women and 79.6 years for men. This obviously affects many things, with the need for more property being one of them. There is £1 trillion of equity held by the over 65’s with many of these people in property bigger than they need. This obviously creates a bit of a bottle neck in the housing market, slowing the natural upwardly mobile flow, due to lack of stock. This does though; also offer opportunities to create new homes that cater specifically to the older population – so more housing, if someone will build it.

More people renting due to high prices

The phrase generation rent has been coined to label this demographic trend. A main cause is the lack of home building going on, party promises of 300,000 new homes a year have consistently been wildly missed, with Full Fact putting the figure at around 148, 384 per annum over the last five years. The natural push from people living longer and staying in their family sized homes in to the twilight years is that the flow of stock is also reduced, which forces prices up and ultimately keeping first time buyers in rentals longer as they struggle to save to get on the property ladder.

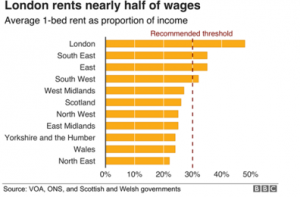

Renters moving away from London

London rents have been on the rise for years but that gap between the North and South has really started to run away. Most parts of the country average rent vs proportion of income is between 20 and 30 % but in London that figure is 50%. This coupled with private landlords selling up therefore reducing choice and yes you guessed it, pushing prices up, is forcing people to seek rentals further afield.

The demographics of renters is changing with more older people renting

Whilst it may be true that much of the property market is stagnant partly due to older generations staying in their large homes, the flip side of this is that there are also more over 60’s who are suddenly looking to rent again. Although the largest age brackets for renters are still between 16-24 & 25-34, there has been a stark rise in renters over 40 in the past decade. A recent study by Hamptons revealed that the number of homes in the UK being rented to people aged over 50 has surged by more than 60% since 2012 and a report compiled by the Centre for Ageing Better (CfAB) showed how the number of over-60s renting privately had risen from 254,000 in 2007 to 414,000 in 2017, predicting that around 30% of people over 60 could be living in private rental property by 2040.

This rise in more senior renters has been attributed to a combination of factors for those who don’t want to stay in their big family house; some people wanting to downsize from to a smaller property that is more manageable and closer to amenities and transport links, parents/grandparents who want to release cash to help the younger generations to get on the property ladder themselves or those wanting to move closer to family who live in a more expensive area.

Climate change and the property market

In our previous blog, Why you should make your rental property more Eco-friendly and how to achieve it, we looked at how tenants are increasingly looking for ‘greener’ homes and how this is becoming a deciding factor when looking for a private rental property. It appears that this is definitely something which landlords will need to focus on for 2020 and beyond to make their investments an attractive proposition to potential renters.

Private Rental Stock Decreasing vs Build to Rent on the Increase

It is projected that the number of private landlords will fall over the next decade due to increased regulations, coupled with a rise in demand for ‘Build to Rent’ homes. Currently there is a viewpoint in the industry that there will be a shift by tenants towards ‘Build to Rent’ property as they can often offer on-site amenities such as gyms and shops as well as being ‘ready to move in’ coming fully furnished with electric, gas and phones all connected on arrival and most even allowing pets. Whilst highly unlikely, looking at current numbers, it has been suggested by some commentators on the subject that it could be possible for much of the rental sector to move to a ‘concierge’ style service for tenants by the end of the decade. However as discussed in another of our blogs on the big crush of the rental sector, one of the major issues with build to rent is that they are not being built fast enough to meet demand, so it looks like the private rental sector will still hold the baton for the near future.

Likely impact of further legislation for Private landlords and agents

Nothing seems to be changing when it comes to imposing new laws on lettings. Here is some information on the upcoming changes for electrical checks and how to stay compliant with the new energy rules:

https://www.alanboswell.com/news/energy-rules-for-landlords/

Brexit

Finally, of course, nobody knows the added impact that Brexit will have on the rental market and beyond – be it positive or negative – but taking into account all of the factors discussed in this blog, there is no doubt that private rental property could well be more in demand than ever by the time we reach 2030!

To keep up to date with the latest news about the London lettings market and for tips and information about protecting your private rental property, follow us on Facebook or LinkedIn.

For further information about any of our inventory services or to book a Property Health Check, get in touch today.